Credit Check Online – Instantly View Your Credit Score

In today’s fast-paced digital world, financial health is just as important as physical well-being. One of the most essential measures of financial stability is your credit score. For many years, people had to rely on banks, lenders, or official reports mailed annually to understand their credit standing. Now, with online tools, you can instantly view your credit score at any time. This convenience allows you to stay informed and make smarter financial choices without delays or uncertainty. cliack here Credit Check Online for more details.

What Is a Credit Score?

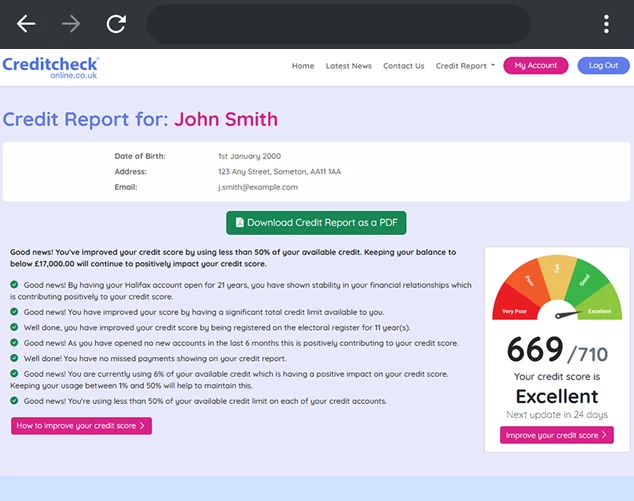

A credit score is a three-digit number that represents how trustworthy you are in the eyes of lenders. It is calculated using your credit history, which includes details such as payment history, outstanding debts, length of credit accounts, and types of credit you use. The most widely used scoring model ranges from 300 to 850, with higher scores indicating stronger financial habits. Generally, a score between 300 and 579 is considered poor, 580 to 669 is fair, 670 to 739 is good, 740 to 799 is very good, and 800 to 850 is excellent. This score not only determines whether you can get approved for credit cards, mortgages, and personal loans, but also influences the interest rates and terms you’ll be offered.

Why Should You Check Your Credit Score Regularly?

Regularly monitoring your credit score provides several advantages. First, it helps you stay financially aware. By knowing where you stand, you can make better decisions before applying for a loan or credit card. For example, if you see your score is slightly below the threshold for “good credit,” you can take steps to improve it before submitting an application. Second, checking your score regularly helps you detect fraud or errors. Identity theft is a growing concern, and sometimes accounts or credit lines can be opened in your name without your knowledge. By checking your score and reviewing your report, you can spot suspicious activity early. Third, it gives you motivation to build better financial habits. Watching your score rise as you make on-time payments, reduce debt, or avoid unnecessary credit inquiries can encourage you to continue practicing responsible money management.

The Benefits of Online Credit Checks

Thanks to technology, you no longer have to wait weeks or pay fees to know your score. Online Credit Check Online platforms provide instant access to your credit rating, often free of charge. The process is simple: you create an account, verify your identity, and within minutes you can view your credit score and sometimes even your full credit report. One major benefit of these services is convenience—you can log in from your laptop or smartphone anytime, anywhere. Another advantage is real-time updates. Many platforms update your score monthly or even more frequently, so you always have the latest information at your fingertips. Some also offer additional tools such as score simulators, which show how certain actions like paying off a balance or applying for a new credit card could affect your score.

How to Check Your Credit Score Online

To check your credit score online, choose a reputable credit bureau or financial service provider. The three major credit bureaus—Equifax, Experian, and TransUnion—each provide online access to credit reports and scores. Additionally, many banks, credit card companies, and independent financial apps now offer free credit score monitoring to their customers. Once you select a service, you’ll need to provide basic personal information such as your name, address, date of birth, and social security number to verify your identity. After verification, your score will be displayed instantly. It’s important to note that checking your own score online is considered a “soft inquiry” and does not affect your credit rating, unlike a “hard inquiry” that occurs when you apply for new credit.

Tips for Improving Your Credit Score

While checking your score is crucial, improving it is equally important. Start by paying all your bills on time, since payment history is the largest factor in most scoring models. Try to keep your credit utilization ratio—the percentage of available credit you’re using—below 30%. Avoid applying for too many new accounts within a short period, as this can lower your score temporarily. Keep older accounts open if possible, because the length of your credit history also plays a role. Lastly, review your credit reports for errors and dispute any inaccuracies, as they can unfairly drag your score down.

Final Thoughts

Being able to check your credit score instantly online is more than just a convenience—it’s a powerful tool for taking control of your financial future. By staying informed, you can make better borrowing decisions, catch errors or fraud early, and work toward achieving a healthier credit profile. Whether you’re planning to buy a home, finance a car, or simply want peace of mind, regularly monitoring your credit score online is a smart and proactive step. Financial awareness begins with knowledge, and thanks to today’s technology, that knowledge is only a click away.

Comments

Post a Comment