How to Check My Credit Score Without Affecting It

Your credit score is one of the most important numbers in your financial life. Whether you’re applying for a loan, renting an apartment, or even setting up utilities, your score plays a role in how lenders and service providers see your reliability. But many people avoid checking their credit because they fear it will hurt their score. The good news is, you can check my credit score safely without damaging it. Here’s everything you need to know.

Understanding Credit Score Basics

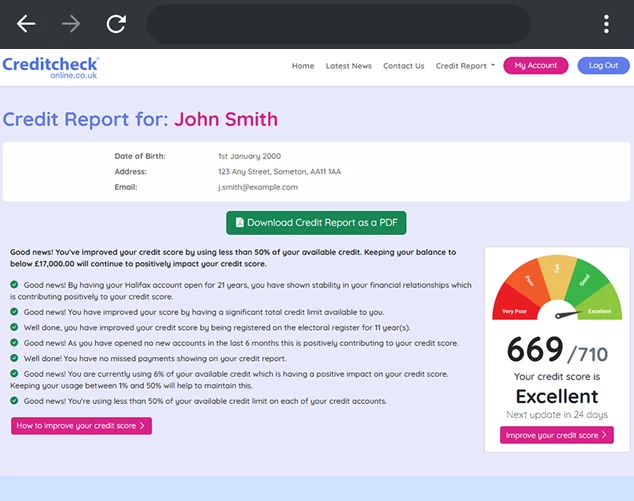

Before diving into how to check your score, it helps to understand what it is. A credit score is a three-digit number, usually ranging from 300 to 850, that reflects your creditworthiness. It’s based on your credit history—things like how much debt you have, whether you pay on time, and how long you’ve had credit accounts.

The higher your score, the more likely lenders are to see you as a responsible borrower. Generally, scores above 670 are considered good, while those above 740 are very good or excellent. Knowing where you stand can help you plan better when it comes to borrowing, budgeting, or improving your financial health.

Why People Worry About Checking Their Score

There’s a common misconception that simply checking your credit score will lower it. This belief stems from the difference between two types of credit inquiries: hard inquiries and soft inquiries.

Hard inquiries happen when a lender checks your credit because you’ve applied for credit (like a loan, mortgage, or credit card). These inquiries can lower your score slightly, though usually by only a few points.

Soft inquiries occur when you check your own score, when employers review your credit as part of a background check, or when lenders pre-approve you for offers. Soft inquiries do not impact your score.

When you’re just checking your own credit score for personal knowledge, it’s always a soft inquiry—meaning it won’t hurt your score at all.

Safe Ways to Check Your Credit Score

There are multiple reliable ways to check your credit score without affecting it:

1. Credit Card Issuers and Banks

Many banks and credit card companies now provide free access to your credit score as part of their online account services. Simply log into your account and look for a “credit score” section. This is usually updated monthly and provides an accurate snapshot.

2. Credit Bureaus

The three major credit bureaus—Experian, Equifax, and TransUnion—are the organizations that calculate and maintain your credit history. Each of them offers tools to view your credit score, often through free accounts or paid upgrades. Accessing your score directly through these platforms is considered a soft inquiry.

3. Free Online Services

There are reputable third-party websites and apps (like Credit Karma, Credit Sesame, or NerdWallet) that allow you to check your score for free. They typically pull data from one or two of the major credit bureaus. Signing up doesn’t hurt your credit, and they often provide additional tools to track your credit health.

4. AnnualCreditReport.com

While this website primarily provides free credit reports (not scores), it’s the only federally authorized source for your full report from each bureau once a year. Reviewing your report is just as important as checking your score, since it shows the details behind your number.

How Often Should You Check Your Credit Score?

Monitoring check my credit score regularly is a smart financial habit. Checking monthly is enough for most people, since scores don’t fluctuate daily unless there’s significant activity like paying off debt or applying for new credit. Regular checks can help you catch errors or identity theft early and give you a chance to fix issues before they impact major financial decisions.

Tips for Maintaining and Improving Your Score

While checking your score doesn’t affect it, your financial habits certainly do. Here are a few tips to keep your credit healthy:

Pay bills on time. Payment history is the single biggest factor in your score.

Keep credit utilization low. Try not to use more than 30% of your available credit.

Limit hard inquiries. Only apply for new credit when necessary.

Review reports for errors. Mistakes on your report can drag down your score.

Maintain old accounts. The longer your credit history, the better it looks.

Final Thoughts

Checking your credit score is not only safe—it’s essential to staying on top of your financial life. As long as you’re reviewing your own score through banks, credit bureaus, or reputable apps, it counts as a soft inquiry and has no negative effect. By making credit checks part of your regular routine, you’ll be better prepared for big financial decisions and more confident about your financial health. Remember: knowledge is power, and in the case of credit, it’s also peace of mind.

Comments

Post a Comment